"The old world is dying, and the new world struggles to be born: now is the time of monsters."

A critical examination of how cryptocurrency markets are inadvertently creating an entirely new form of human organization

The Dawn of a New Day

We need to stop pretending we understand what's happening. The launch of Trump's meme coin isn't just another cryptocurrency, another ethical scandal, or another political innovation. It's the first working prototype of an entirely new form of human organization: Algorithmic Governance.

Our fundamental frameworks for understanding political power are not just outdated – they're dangerously obsolete. The advent of $TRUMP heralds an unprecedented confluence, transcending the ordinary meeting of politics and markets. This integration creates a self-perpetuating structure where political authority, economic mechanics, and strategic maneuvering coalesce into an entity that eclipses conventional concepts of governance.

The implications are so groundbreaking that our current intellectual frameworks—be it political science, economics, game theory, or constitutional law—fall short when trying to grasp the magnitude of what is unfolding. We need to reconstruct our understanding from first principles.

The Death of Traditional Politics

The moment Trump launched $TRUMP, traditional political science became obsolete. We're no longer dealing with the quaint mechanics of votes, approval ratings, and polling data. We've entered a realm where political power isn't just measured by markets – it's literally made of markets.

Consider this unprecedented scenario: For the first time, individuals and entities can buy a direct stake in presidential success, transforming political allegiance into a financial asset. Foreign governments, through the veil of anonymity provided by global trading platforms, can now secure leveraged exposure to U.S. policy decisions. Presidential statements have transitioned from mere political discourse to influential trading triggers, moving markets with every word.

Such possibilities were inconceivable before but have become reality in the landscape forged by $TRUMP.

Think about this: When was the last time you could buy a direct stake in presidential success? When could foreign governments gain leveraged exposure to U.S. policy decisions through anonymous trading accounts? When did presidential statements become literal trading events?

The answer is never. Until now.

The Architecture of Power 2.0

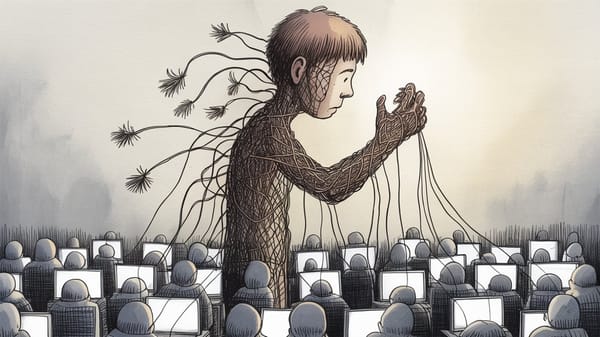

Forget everything you know about political systems. The technical architecture of $TRUMP creates something entirely new: a hybrid organism that's half democracy, half trading algorithm, all nightmare.

The specifications are deceptively simple:

- 1 billion tokens created from nothing

- 80% controlled by the Trump Organization

- No utility beyond "expressing support"

- Instant global trading

But this simplicity masks something profound: the first working prototype of programmable political capital. Every token is simultaneously a share of presidential success, a governance vote, and a speculation vehicle. The implications are staggering. We have entered uncharted territory where the very essence of power is not only bought and sold but engineered and optimized like financial algorithms.

Welcome to the Political Casino

Here, influence is not wielded quietly in the corridors of power; it is flashed in the blinding neon lights of market volatility. Imagine a casino where the chips are pieces of presidential influence, and not only is the house aware of your every move—they dictate them.

Policies are no longer crafted behind closed doors but are laid bare on trading platforms for eager investors to eye and exploit. Now imagine this casino controls nuclear weapons and the outcome isn't simply monetary gain or loss, but global stability.

Let's meet our players, shall we? Those navigating this high-stakes environment are more than mere participants—they are architects and influencers of the very governance structures that shape our world. The game has changed, and these players are finding their alliances and strategies tested in unprecedented ways.

Let's meet our players:

The True Believers (Token Holders)

They think they're investors. They're actually participants in the largest game theory experiment in human history. Every token holder becomes a walking conflict of interest, financially incentivized to support presidential decisions regardless of merit. Democracy becomes a derivative product.

The Resistance (Opposition Forces)

Traditional political opposition now comes with a price tag. Want to criticize the president? Watch your portfolio tank. Unless, of course, you're smart enough to short the token first. We've created a system where principled resistance becomes mathematically irrational.

The Market Architects (Trading Platforms)

These aren't exchanges – they're the new parliaments. Every order book is a voting machine. Every trade is a political act. The people controlling these platforms have quietly become the arbiters of political reality.

The Sovereign Trader (The President)

Imagine being able to trade on perfect information about your own decisions before you make them. That's not insider trading – that's Thursday at the White House.

The Playbook of Power

In the landscape defined by Algorithmic Governance, the interplay of politics and markets spawns strategies that resemble both Machiavellian schemes and market innovations. Let's dissect these strategies further to comprehend their gravity and potential consequences.

The Policy Pump: An In-Depth Look

The Policy Pump strategy exploits the intrinsic volatility of the political token market. More than mere market manipulation, it symbolizes a systematic approach to amplify profitability by maneuvering within the realm of governance itself.

- Create Regulatory Uncertainty: The strategy begins by leveraging governmental ambiguity. By withholding policy clarity or releasing vague regulatory positions, the initial price destabilization of the political token is almost inevitable. This is akin to central banks utilizing interest rate speculation to influence markets, but scaled to political dimensions.

- Market Decline and Accumulation: As uncertainty drives prices down, strategic players prepare to buy at a discount. The concept mirrors traditional stock market tactics, where strategic investments are made during downturns with foresight on future recovery.

- Achieving Resolution and Clarity Announcement: Once key players have secured advantageous positions, an announcement can serve as the catalyst for recovery. Revealing new policies or offering clarity prompts market confidence, driving demand and, consequently, prices up.

- Profit Realization: Investors who capitalized during periods of ambiguity can now liquidate their positions for profit. The ethical considerations in play here echo insider trading concerns but operate within the bounds of a yet-to-be-regulated domain.

Crisis Architect: Under the Hood

The Crisis Architect model adopts an even more audacious approach. It institutionalizes crisis as a market-making event.

- Crisis Creation: Artificially or deliberately generated disturbances, such as geopolitical tensions or domestic instability, serve as the opening move. Such practices are risk-laden and reminiscent of past military-industrial complex conspiracies but take a financial approach.

- Market Response and Exploitation: Volatility becomes a tool, not a threat. Experienced traders thrive amid upheaval, transforming uncertainty into an environment rich with arbitrage opportunities.

- Crisis Resolution: The orchestrator eventually unveils solutions or peace offerings, which in turn stabilize the market. This last act mirrors diplomatic resolutions but occurs alongside financial gain rather than moral reputations.

Diplomatic Short Squeeze: Mechanics Explained

This strategy represents a convergence between foreign policy maneuvering and sophisticated market dynamics.

- Establishing Short Positions: Identifying vulnerabilities or impending decisions at the international level, players may establish short-market positions anticipating declines.

- Crisis Engineering: Provoking or exacerbating political disputes naturally aligns with push strategies in negotiation contexts—just reimagined through the lens of financial leverage.

- Panic and Price Movement: Strategic announcements swing market moods, synchronizing political timing with market liquidity.

- Cover Short Positions and Resolution: Through careful timing, covering short positions amid panic becomes highly profitable. The eventual de-escalation underlines both trader skill and political acumen.

These strategies, while theoretical and extreme, are not impossible scenarios given the underpinnings of Algorithmic Governance. They provide a glimpse of a future where political actions are obfuscated by market intents, challenging our foundational concepts of sovereignty, governance, and ethics.

Understanding these strategies is crucial as societies grapple with expanding digital influence and governance models. As we navigate these uncharted waters, a rigorous and ethical dialogue ensures these potential realities remain monitored and most importantly, that humanity—not mere algorithms—remains at the helm of governance.

Diplomacy isn't dead – it just moved to the order book.

The Death of Sovereignty

Traditional national sovereignty assumed nations were discrete entities engaged in diplomatic relations. That model is now obsolete. When presidential wealth fluctuates in real-time based on token prices, and those prices can be manipulated by anonymous global actors, we've created something new: programmable sovereignty.

Consider these attack vectors:

The Sovereign Stake

What happens when China accumulates a significant token position through proxies? Every policy decision becomes a potential trigger for market manipulation. Traditional sanctions become irrelevant when you can crash a president's net worth with a single trading algorithm.

The Liquidity Weapon

Control market liquidity, control policy. It's that simple. When presidential wealth depends on token prices, and token prices depend on market liquidity, whoever controls the order book controls the presidency.

The Information Cascade

Strategic information release becomes a weapon of mass market destruction. Each leak, each announcement, each diplomatic cable becomes an opportunity for coordinated trading attacks. Information warfare meets algorithmic trading.

Beyond Democracy

We need to stop asking whether this system is good or bad. That's like asking whether gravity is ethical. We're dealing with the emergence of a new form of human organization – one that merges political power, market mechanics, and game theory into something entirely new.

The questions we should be asking:

- Can traditional democracy survive first contact with algorithmic governance?

- What happens when political power becomes fully programmable?

- How do we regulate a system designed to capture its own regulators?

The Crossroads of Human Organization

As we stand at this pivotal juncture, our choices will profoundly shape the future of governance. The two divergent paths offer distinct prospects, each with unique challenges and unforeseen consequences.

Path One: Embracing Traditional Democracy

Despite its flaws, traditional democracy remains a cornerstone of governance. Its foundational principles emphasize representation, the rule of law, and the separation of powers. This path, though forged through historical experiences, invites us to fortify humanity's ethical and philosophical underpinnings.

- Ethical Governance and Human Values: Making the conscious choice to uphold ethical considerations, human rights, and justice safeguards societal interests. Governance built upon the voices of individuals remains central to fostering human dignity and compassion.

- Balancing Adaptation and Tradition: Navigating advancements necessitates adapting democratic mechanisms to address technology's influence while maintaining core democratic principles. Striking this balance provides ongoing legitimacy to decision-making structures.

- Addressing Limitations Through Innovation: The traditional democratic system's inherent issues—e.g., political polarization, inefficiencies, and bureaucracy—require innovative and effective solutions. Strengthening democratic institutions demands timely reform and modernization efforts.

Path Two: Venturing into Algorithmic Governance

Conversely, algorithmic governance revolutionizes societal organization by leveraging programmable mechanisms, seamless integration of technology, and decentralization. This path holds the allure of efficiency, data transparency, and groundbreaking possibilities, but also harbors critical uncertainties.

- Technocratic Efficiency vs. Democratic Value: Algorithmic systems promise to streamline decision-making processes with unmatched precision. However, the reduction of human agency and prioritization of optimization risk undermining democratic values, marginalizing ethical considerations.

- Regulation and Accountability Complexities: Governing such a system demands reevaluating traditional regulatory frameworks. To prevent monopolization and abuse, regulation must evolve rapidly to stay at pace with technology's exponential growth—a formidable challenge.

- Decentralization and Resource Redistribution: The potential decentralization of power defies historical concentration within nation-states. While distributing authority presents equitable opportunities, it raises questions about resource access and potentially deepens global asymmetry.

Charting Our Future Course: Informed Synthesis

Our challenge lies in cultivating an informed synthesis—fusing time-honored democratic principles with innovative algorithmic solutions. Effectiveness entails preserving core human values while responsibly harnessing the power of technology to achieve superior governance outcomes.

The decision ahead is not straightforward; it requires deliberate, collective action and a shared vision to mitigate risks and ensure that human priorities remain central to developing governance models. As society steps forward on these intertwining paths, dialogue, collaboration, and vigilance are imperative to steering the future landscape toward progress, inclusivity, and resilience.

The choice isn't ours to make. The moment $TRUMP launched, we crossed a threshold. We're now living in the prototype of the first algorithmic state, and there's no going back.

The only question is: Are we smart enough to understand what we've created before it understands us?

Khayyam's specializations extend to the intersection of game theory, political systems, and emerging technologies. His work focuses on novel power structures in the digital age. This analysis should be treated as a theoretical framework for understanding unprecedented dynamics, not as commentary on any specific political entity or investment advice.

Member discussion