“The greatest enemy of knowledge is not ignorance, it is the illusion of knowledge.”

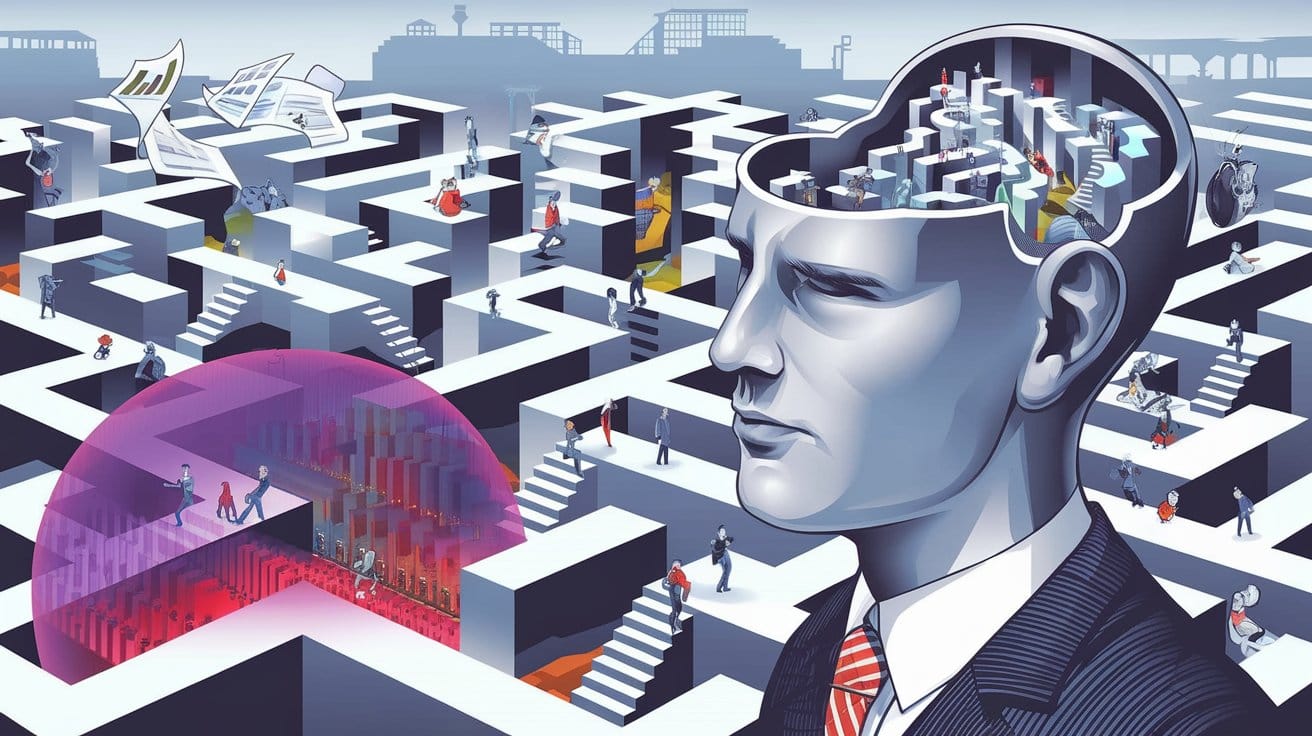

A Tale of Misunderstood Minds and Missed Opportunities

Why do billion-dollar companies consistently fail to understand basic human psychology? Consider a scene playing out daily across Britain's rail network: Hundreds of business travelers arrive at London's Paddington Station precisely 45 minutes early for their trains to Manchester. They watch—frustrated, resigned, yet powerless—as earlier trains depart with empty seats they're not allowed to board, despite having already paid for their tickets.

The rail company's proposed solution to customer complaints about journey times? A £60 billion high-speed rail project that would reduce trip duration by 40 minutes. Yet behavioral scientist Rory Sutherland proposes an elegantly simple alternative: Let passengers who arrive early take earlier trains for a small fee. Cost to implement: £200,000 for an app. The benefit? The same reduction in perceived journey time as the multi-billion-pound infrastructure project.

This stark disparity raises a profound question: How can businesses spend millions on consumer research yet misread human nature so fundamentally? The answer is the "Great Marketing Delusion"—which I define as a systematic failure to understand the relationship between objective reality and human experience.

The Great Marketing Delusion: The persistent belief that consumer behavior can be understood and optimized through purely objective metrics, ignoring the fundamental role of psychological construction in human experience.

Standing in gleaming corporate headquarters worldwide, watching PowerPoint presentations filled with regression analyses and optimization algorithms, one might be forgiven for thinking we've mastered the science of consumer behavior. The only problem? It's all built on a fundamental misunderstanding of how human beings actually experience the world.

What if everything we think we know about consumer behavior is wrong? What if our entire approach to understanding market dynamics is fundamentally flawed because it fails to account for the way human consciousness actually constructs experience?

This isn't merely an academic question. The gap between business metrics and human psychology costs companies billions in wasted investments, drives countless businesses to bankruptcy, and—paradoxically—makes life worse for the very customers they're trying to serve. To understand why, we must first confront a startling truth about human perception: much of what we experience as reality doesn't exist in the objective world at all.

The Crisis of Understanding

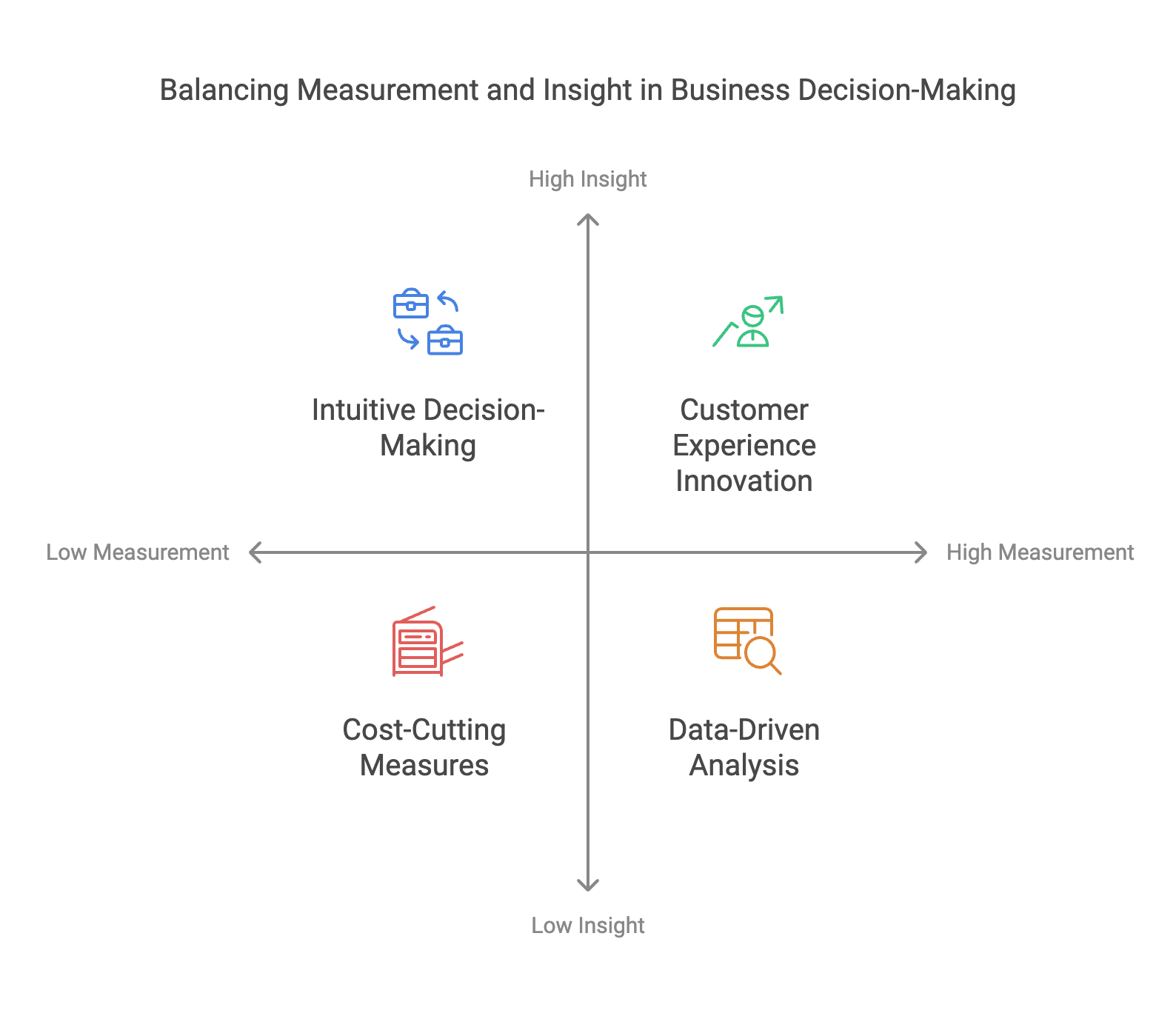

In corporate boardrooms worldwide, a quiet war rages between marketing departments and finance teams. The weapons of choice? Spreadsheets versus human insight. The battlefield? The nature of value itself. This conflict represents more than just departmental squabbling—it reflects a fundamental epistemological failure in how organizations conceptualize human decision-making.

"The bastard with the spreadsheet always wins," observes Sutherland, pointing to a pervasive bias in business decision-making. If someone suggests cost-cutting measures, they sail through approval processes with minimal scrutiny. Propose spending money to improve the customer experience? Prepare for months of justification, multiple rounds of approval, and demands for guaranteed ROI calculations.

This bias toward numerical analysis creates a Measurement Paradox:

When businesses obsess over precise metrics (like conversion rates down to decimal points or minute-by-minute engagement data), they often miss the basic human factors that actually drive decisions.

For example: A coffee shop might meticulously track average transaction times but completely overlook how the smell of fresh-baked pastries or a barista's friendly greeting shapes the entire customer experience.

It's like trying to understand why people fall in love by measuring their heart rates. Sure, you'll get exact numbers, but you'll miss the whole point.

To address these systematic failures in business decision-making, we need to critically examine our assumptions about how people perceive value and make choices. This examination reveals practical insights that can transform both business strategy and our understanding of customer behavior.

In the sections that follow, we'll explore:

- How our brains construct reality itself

- Why the most successful businesses often ignore traditional metrics

- The evolutionary psychology of pricing

- A new framework for business decision-making that aligns with human psychological reality

The journey begins with a simple question that challenges everything we think we know about human perception: Why do our brains create the color purple when it doesn't exist in reality?

The Cognitive Architecture of Value

Consider, for a moment, the color purple. Not its cultural associations or symbolic meaning, but the physical sensation of perceiving purple itself. Here's a startling truth: purple doesn't exist as a wavelength of light. What we experience as purple is our brain's creative solution to receiving both red and blue signals with no green. This isn't a quirk or anomaly—it's a window into how human consciousness fundamentally operates.

The Construction of Reality

What if our entire understanding of consumer behavior is as illusory as the color purple? This isn't mere philosophical speculation. The evidence for the constructed nature of human experience is everywhere:

The Perception-Value Principle: Value does not exist as an inherent property of products or services, but emerges from the interaction between physical reality and neural processing.

Consider these empirically documented phenomena:

- Wine tastes measurably better when poured from a heavier bottle

- Branded painkillers demonstrate superior efficacy to identical generic versions

- Chocolate's perceived sweetness changes when molded into different shapes

- Cars genuinely "drive better" after being washed

- Food taste improves in restaurants with superior ambiance, regardless of actual quality

These aren't mere psychological tricks or marketing gimmicks—they represent the fundamental nature of human experience. When Cadbury changed the shape of its chocolate bars without altering the recipe, customers didn't imagine a difference in taste; their brains literally constructed a different taste experience.

The Neural Architecture of Value

Why would evolution design our brains to "lie" to us so consistently about reality? The answer reveals a profound truth about human decision-making: our perceptual systems didn't evolve to provide an accurate representation of reality but to help us survive and reproduce.

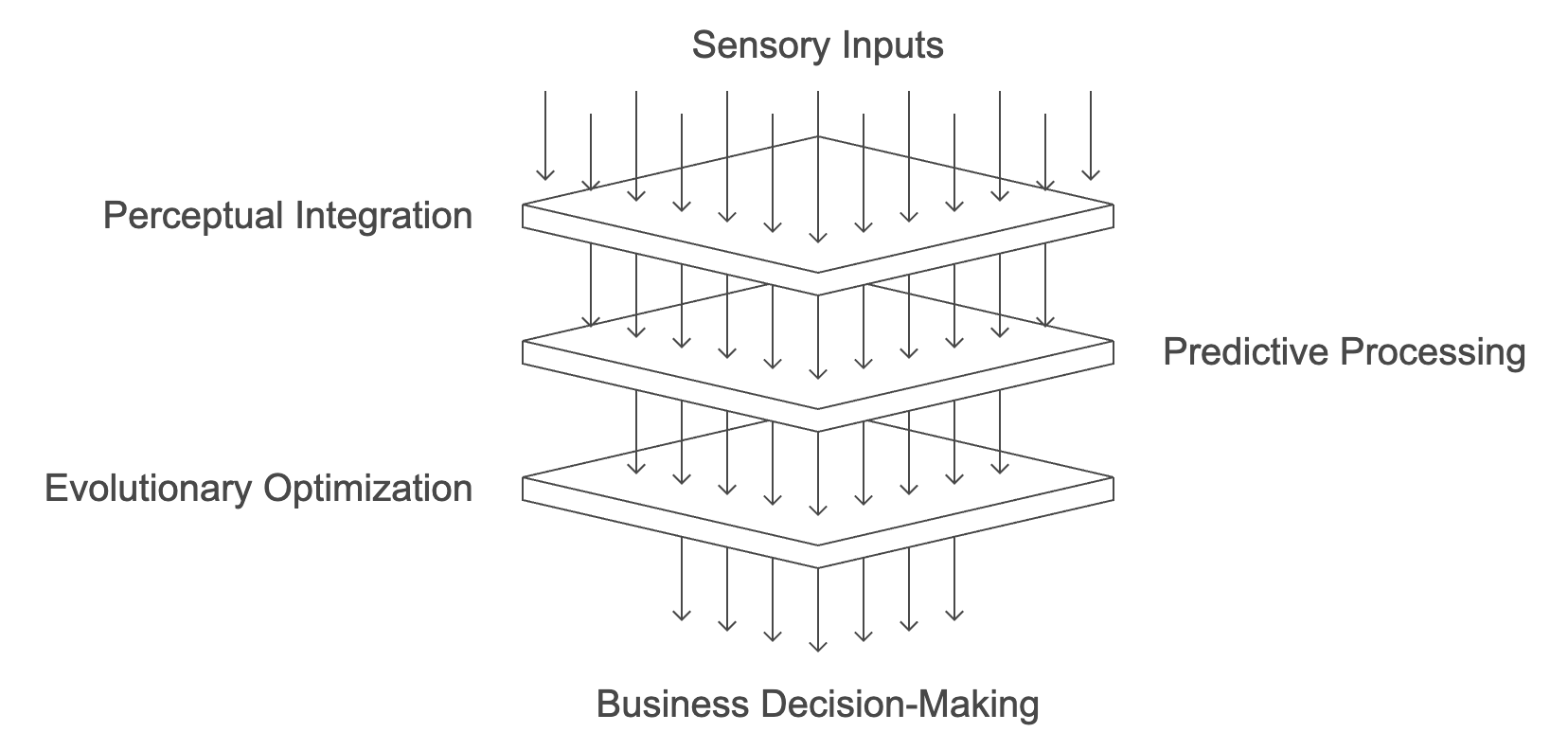

The Adaptive Construction Model explains this phenomenon through three key mechanisms:

- Perceptual Integration: The brain combines multiple sensory inputs into unified experiences, value perception emerges from this integration process, and context becomes inseparable from content

- Predictive Processing: Our brains constantly generate predictive models of reality, these predictions shape actual experience, and expectations literally create reality.

- Evolutionary Optimization: Neural systems prioritize fitness over accuracy, "Good enough" solutions dominate perfect ones, and efficiency trumps objectivity

This neural architecture has profound implications for business decision-making. Consider the mathematics of traditional market analysis:

The Traditional Value Equation:

Perceived Value = Objective Quality + Marketing Effect

But our understanding of neural processing suggests a fundamentally different model:

The Neural Value Equation:

Perceived Value = ∫(Context × Expectation × Sensory Input) dt

This isn't just theoretical—it explains why seemingly irrational business strategies often succeed where "logical" approaches fail. The success of Red Bull, selling less liquid at higher prices in smaller cans while deliberately making it taste medicinal, becomes comprehensible only through this neural lens.

The Business Implications

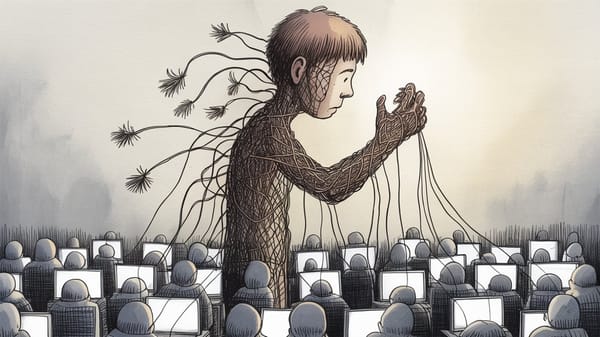

What happens when we take this understanding of human perception seriously? First, we must confront an uncomfortable truth: most business metrics are measuring shadows on the wall of Plato's cave. When Samsung charges $200 more for a functionally identical television, they're not selling better components—they're selling better neural predictions.

This leads us to a revolutionary insight: successful businesses don't succeed by maximizing objective value, but by aligning with the brain's inherent pattern-recognition and meaning-making mechanisms.

The Measurement Fallacy

How do you measure a customer's experience? This seemingly straightforward question conceals a profound paradox that undermines much of modern business thinking. To understand why, we must first confront an uncomfortable parallel between quantum physics and consumer psychology: the act of measurement fundamentally alters what's being measured.

The Observer Effect in Business

Consider a remarkable discovery made by London Underground: Customer satisfaction improved more from installing countdown clocks showing train arrival times than from actually running more frequent trains. This wasn't a minor effect—it was a massive improvement in perceived service quality, achieved at a fraction of the cost of adding trains.

The Measurement Paradox: In human systems, the act of measuring an experience fundamentally alters that experience, often in ways that render the original measurement meaningless.

This principle explains several seemingly disparate business phenomena:

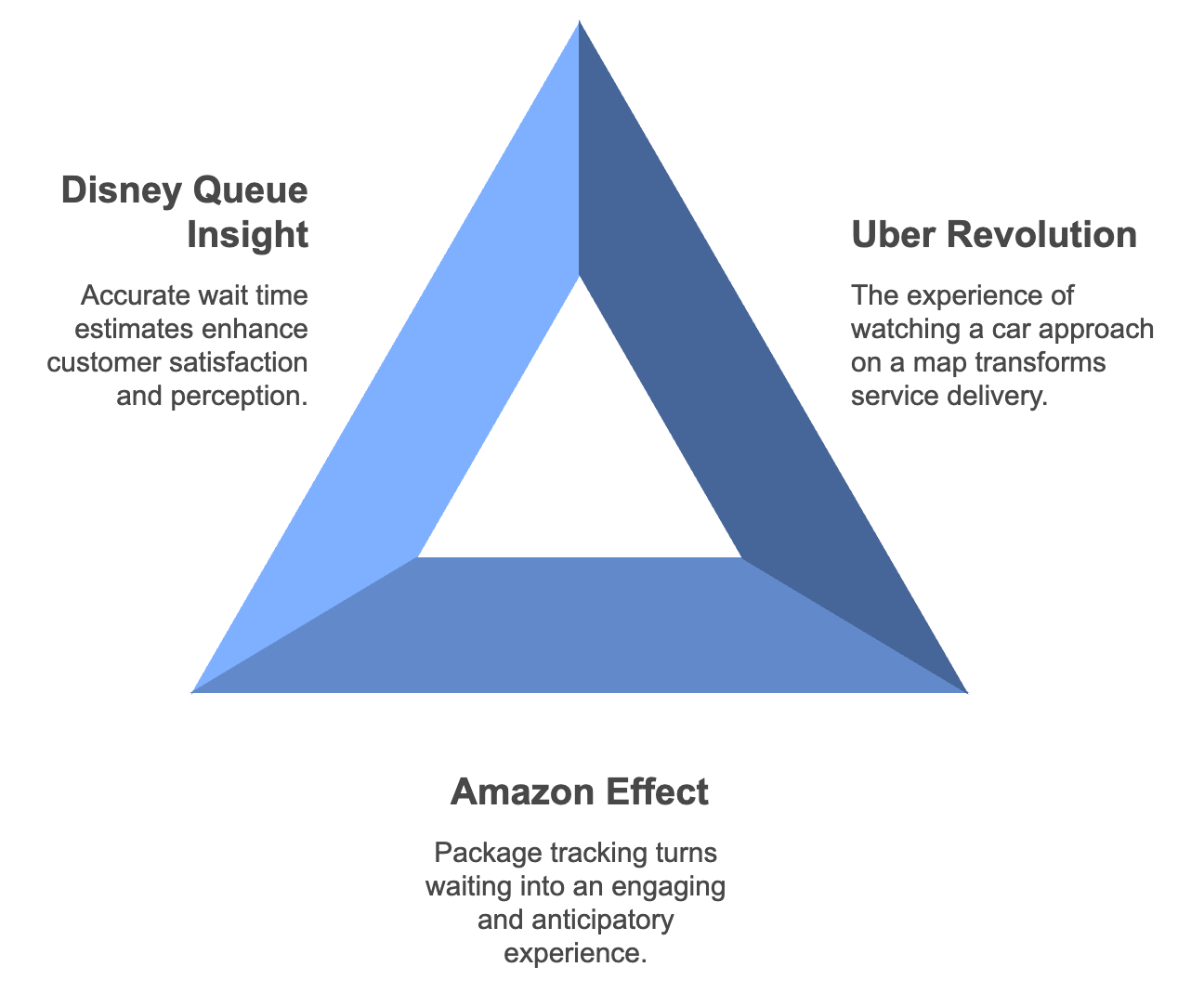

- The Uber Revolution: The core innovation wasn't ordering cars by phone (possible for decades), the revolutionary element was watching your car approach on a map, the measurement became the experience.

- The Amazon Effect: Package tracking transformed waiting into engagement, uncertainty converted to anticipation, measurement created value.

- The Disney Queue Insight: Posted wait times typically overestimate by 20%, customers report higher satisfaction when rides "beat the clock", the measurement shapes the narrative.

The Numbers Trap

"The bastard with the spreadsheet always wins," notes behavioral scientist Rory Sutherland, pointing to a systematic bias in business decision-making. But what if this devotion to numerical analysis is actively destroying value? Let's examine how number-focused thinking creates three critical blindspots:

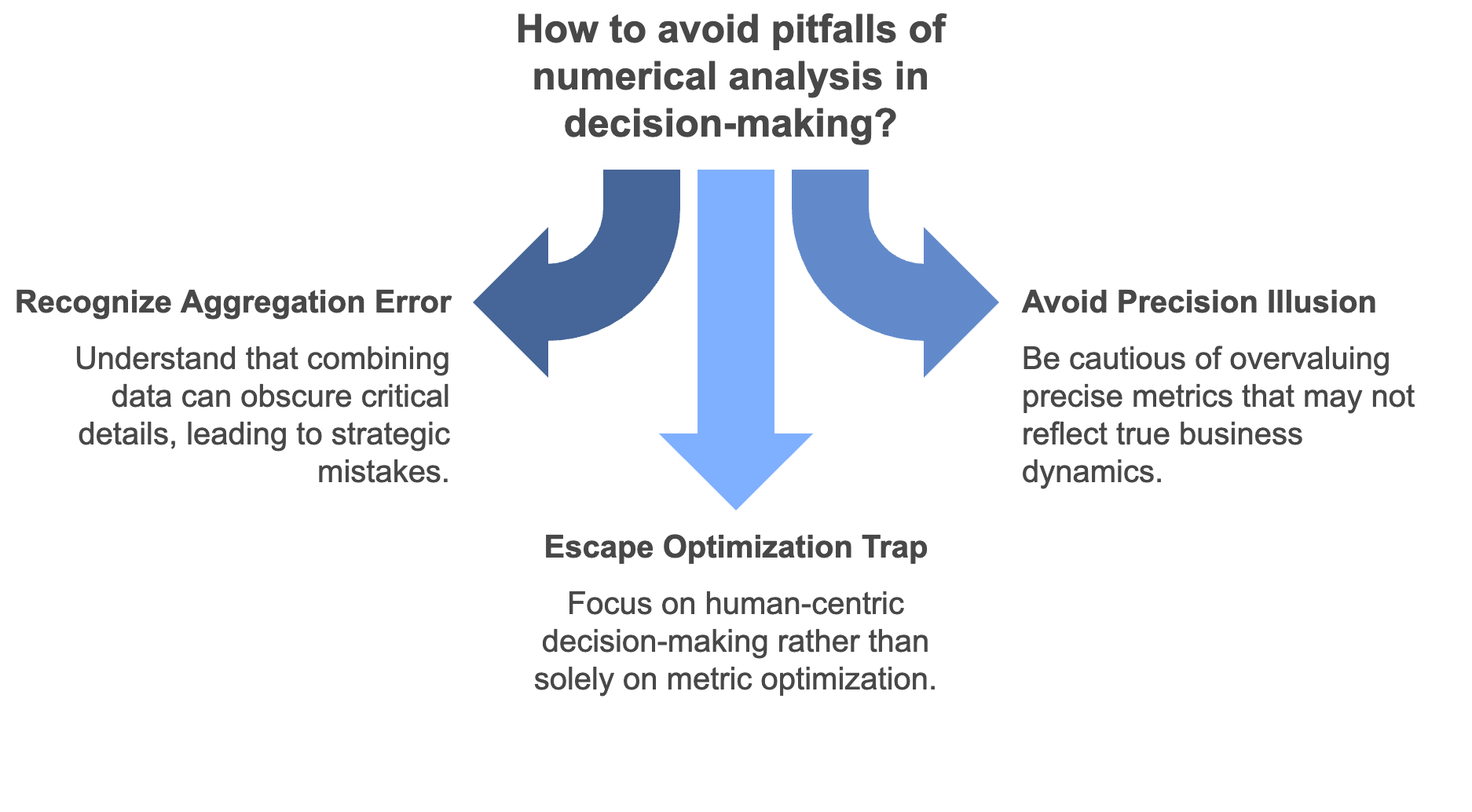

1. The Aggregation Error

Consider this fundamental mathematical truth: "Whenever you add numbers together or multiply numbers, you lose information." This isn't a minor technical point—it's a devastating critique of how businesses analyze data. Example:

- One person buying eight items ≠ Eight people buying one item

- Yet in sales data, they appear identical

- This loss of information leads to catastrophic strategic errors

2. The Precision Illusion

What appears more credible?

- A: "This will improve customer satisfaction"

- B: "This will improve customer satisfaction by 23.7%"

Most business leaders choose B, demonstrating the "Precision Fallacy"—the belief that more decimal places equal more truth. This bias leads organizations to:

- Overvalue easily measured metrics

- Undervalue crucial psychological factors

- Make systematically wrong decisions

3. The Optimization Trap

Traditional business thinking focuses obsessively on optimization—finding the "best" solution according to measured metrics. But human decision-making operates differently. Consider this provocative example:

The Dart Player's Dilemma: In darts, the highest-scoring target (triple 20) sits next to the lowest-scoring area on the board. Expert players often aim for triple 19 instead—a slightly lower score but with much less catastrophic consequences for missing.

This principle explains countless business phenomena that appear irrational under traditional metrics but make perfect sense through the lens of human psychology.

The Psychology of Pricing

What if everything we know about pricing is wrong? Consider this paradox: Red Bull became a global phenomenon by selling less liquid than its competitors, in smaller cans, at higher prices—and making it taste deliberately medicinal. Through conventional economic logic, this strategy appears suicidal. Yet it worked spectacularly. Why?

The Neural Architecture of Price

To understand this apparent contradiction, we must first grasp a fundamental truth about human cognition: price perception operates more like a neural network than a calculator. Consider this framework:

The Price-Value Matrix: A dynamic system where price serves not just as a cost signal but as a crucial input into the experience of value itself.

This neural architecture operates through three interconnected mechanisms:

1. The Coherence Cascade

When Red Bull prices itself at a premium and creates a medicinal taste, it triggers what I term a coherence cascade:

This isn't just clever marketing—it's a sophisticated exploitation of how our brains construct reality. The high price and unusual taste aren't barriers to success; they're essential components of the value experience.

2. The Signaling Paradox

Traditional economic theory suggests that lower prices increase demand. Yet consider these counter-examples:

- The Veblen Effect: Luxury goods that sell more when prices increase

- The Placebo Premium: Branded medicines working better than identical generics

- The Quality Assumption: Wine tasting better from heavier bottles

These aren't market anomalies—they reveal fundamental truths about neural value construction.

The Signal Integration Principle: Price acts as a crucial input signal in the brain's construction of experiential value.

3. The Uncertainty Resolution Model

Perhaps the most fascinating aspect of pricing psychology emerges from the Uncertainty Resolution Model. Consider Ryanair's counterintuitive marketing strategy:

Instead of highlighting similarities to traditional carriers while emphasizing lower prices (the "logical" approach), they aggressively advertised what they didn't offer:

- No meals

- No assigned seats

- No frills

Why did this work? Because it resolved a crucial uncertainty in customers' minds. Without understanding what they weren't getting, customers might have assumed the worst about critical factors like aircraft maintenance or pilot training.

The Evolutionary Logic of "Irrational" Pricing

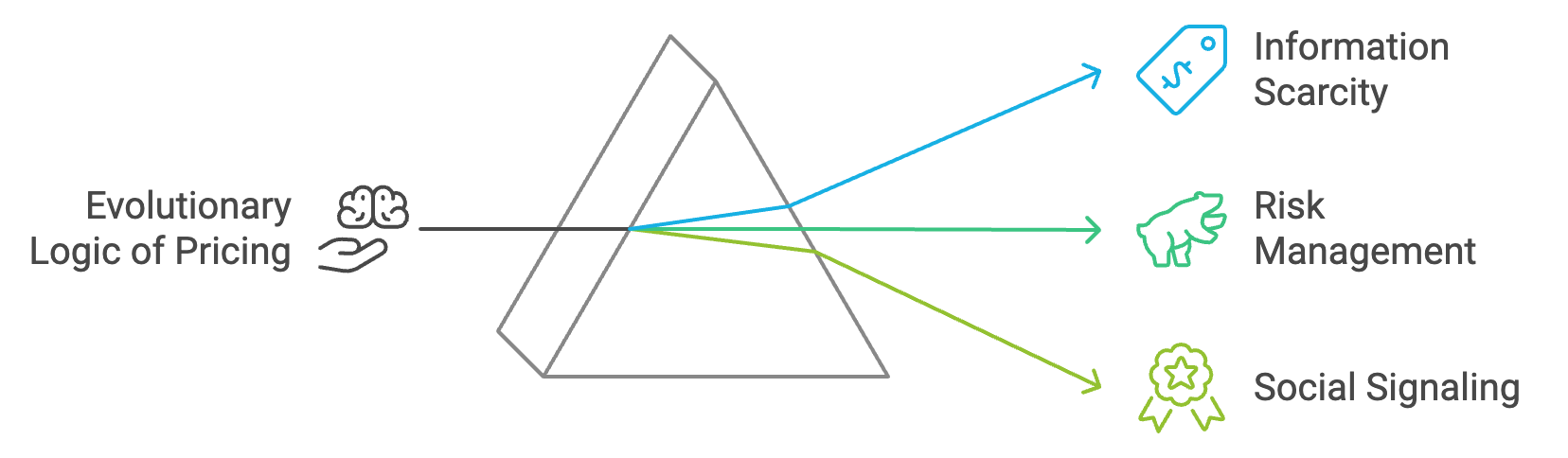

Why would our brains evolve such seemingly irrational price-processing mechanisms? The answer lies in what I term adaptive value construction, and it reveals deep truths about how our ancestors navigated an uncertain world.

In ancestral environments, information was scarce and survival often depended on making quick yet accurate judgments about resource value. Price - or more broadly, the cost of acquisition - served as a crucial quality signal. When something required significant effort or resources to obtain, that high cost typically indicated genuine value and substantial investment. Over time, this created evolutionary pressure for our brains to strongly associate price with quality.

This association was further reinforced by the brutal realities of risk management in prehistoric environments. When uncertainty about quality could mean the difference between life and death, using price as a reliable proxy for resource investment made adaptive sense. Our brains evolved to use price as a quality heuristic simply because, more often than not, it worked.

But perhaps most fascinating is how deeply this mechanism became entangled with social signaling. As our ancestors developed more complex social structures, value perception evolved in increasingly sophisticated social contexts. Price became not just a measure of material worth, but a powerful signal of social status and group belonging. Our neural systems integrated price so fundamentally into experience construction that it became inseparable from how we perceive value itself.

This evolutionary framework explains why premium pricing strategies often succeed even when they appear to violate economic rationality. They're not fighting against human nature - they're aligning perfectly with how our brains naturally construct value.

This evolutionary framework explains why premium pricing strategies often succeed even when they appear to violate economic rationality.

A New Framework for Business Decision Making

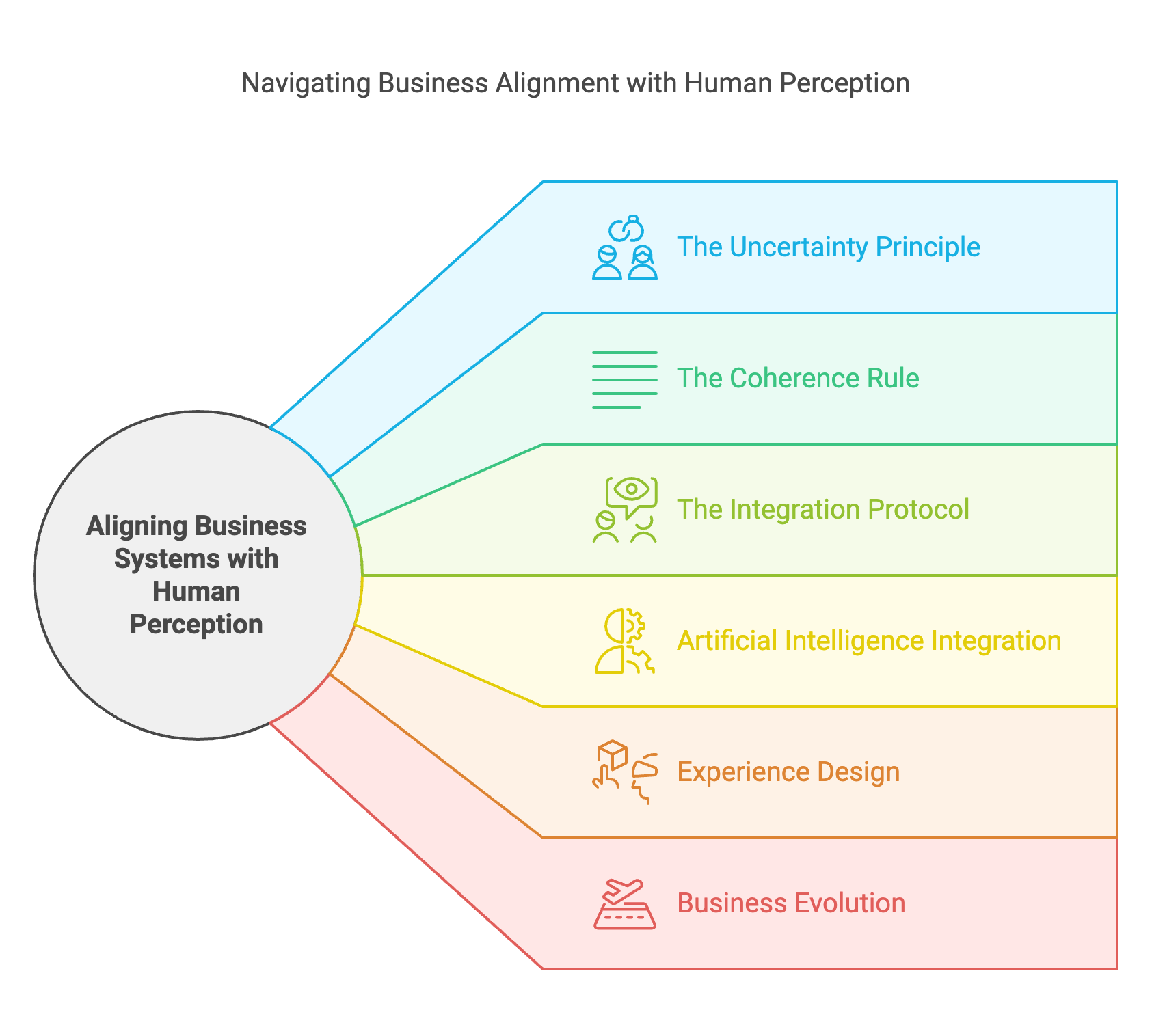

How do we translate these insights into actionable business strategy? What if we could design systems that work with, rather than against, the brain's inherent architecture? The answer lies in the Neurometric Business Design—a systematic approach to aligning business decisions with human psychological reality.

The Integration Framework

Neurometric Business Design: A systematic methodology for creating business solutions that align with the brain's natural value-construction mechanisms while maintaining measurable performance metrics.

This framework operates through three interconnected layers:

1. The Perception Layer

How customers construct their experience

Instead of asking "What service are we providing?" start with:

- How do customers construct their experience of our service?

- What contextual factors shape their perception?

- Which elements of uncertainty create anxiety?

Case Study: British Gas Engineers Traditional approach: Reduce appointment windows Neurometric solution: Text customers 30 minutes before arrival Result: Higher satisfaction with no change in actual wait times

2. The Signal Layer

How business actions translate into customer perception

Consider these signal integration principles:

- Coherence: All signals must tell a consistent story

- Credibility: Signals must align with customer expectations

- Context: Signals gain meaning through environmental interaction

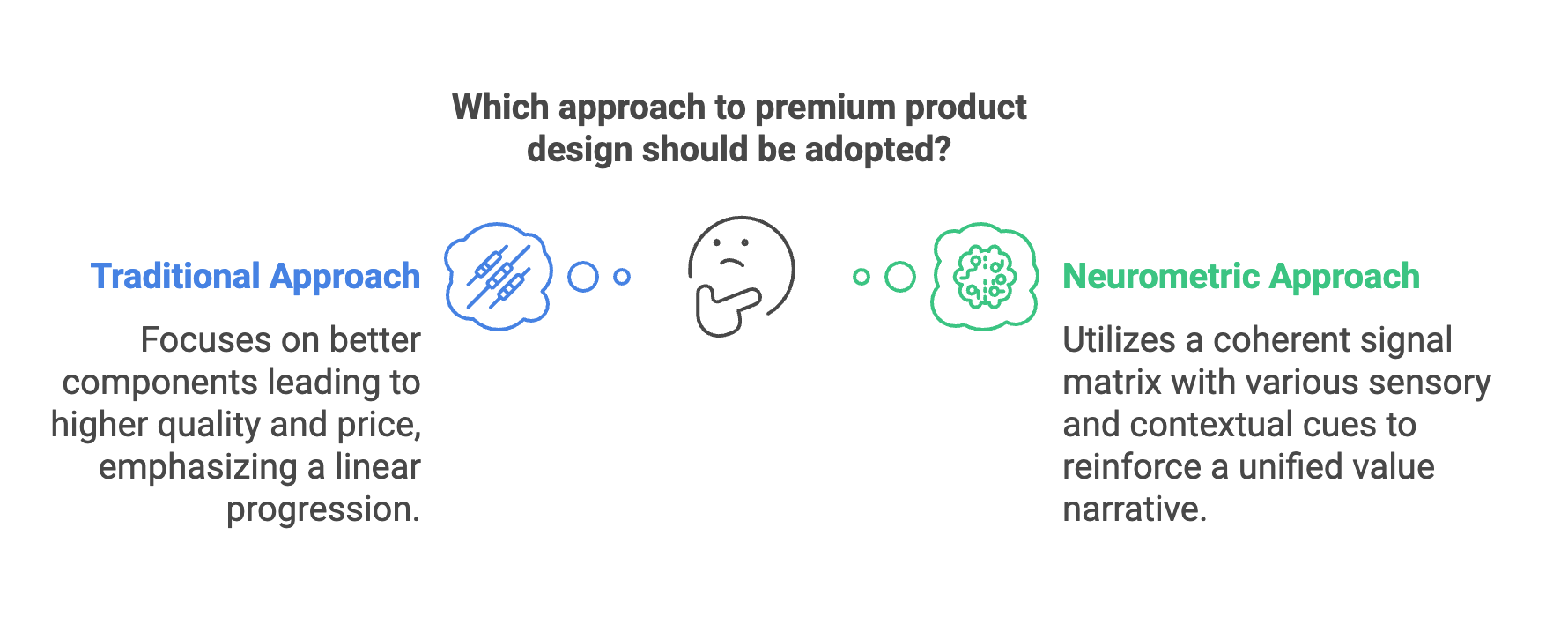

Applied Example: Premium Product Design

3. The Measurement Layer

How we track and optimize performance

Traditional metrics often destroy value by focusing on the wrong variables. Instead:

- Experience Metrics: Measure uncertainty reduction, track coherence of value signals, and monitor context stability.

- Integration Metrics: Signal alignment scores, context congruence index, and value narrative consistency.

- Outcome Metrics: Traditional KPIs reframed through neurometric lens, long-term value construction patterns, and system-wide coherence measures.

Practical Implementation

How does this work in practice? Consider these implementation principles:

1. The Uncertainty Principle

Before adding features or improving services, ask:

- What uncertainties create customer anxiety?

- How can we make processes more visible?

- Where can we convert waiting into engagement?

2. The Coherence Rule

Examine your entire value proposition for signal alignment:

- Do pricing signals match experience expectations?

- Does product design reinforce value narratives?

- Are contextual cues supporting core messages?

3. The Integration Protocol

Develop systematic approaches to map customer experience construction, identify key signal touchpoints, and design coherent value narratives.

Future Implications

This framework has profound implications for:

Artificial Intelligence Integration:

- How do we design AI systems that work with human perception?

- Can we create algorithms that optimize for psychological reality?

- What new metrics will emerge from this integration?

Experience Design

- Moving beyond user interface to perception interface

- Creating coherent multi-sensory value narratives

- Designing for the brain's natural architecture

Business Evolution

- The shift from optimization to coherence

- New models of value creation

- The emergence of neurometric organizations

As we move into an era of unprecedented technological capability, understanding how to align business systems with human psychological reality becomes not just an advantage but a necessity. The companies that thrive will be those that master the art of designing for the brain's natural architecture while maintaining the rigor of systematic business practice.

The Future of Human-Centered Business

Let us return to Paddington Station, where our journey began. Those empty seats on earlier trains represent more than just an operational inefficiency—they symbolize the grand challenge facing modern business: the gap between objective reality and human experience.

What have we learned from our exploration of this gap?

The Neural Revolution in Business

First, we've discovered that human experience isn't just influenced by psychology—it's constructed by it. The color purple, nonexistent in physical reality yet vivid in our experience, serves as a powerful metaphor for how value itself emerges from the interaction between objective reality and neural processing.

The Fundamental Insight: Business success depends not on optimizing objective metrics but on aligning with the brain's natural architecture for constructing meaning and value.

This insight leads us to a revolutionary conclusion: Many of our most basic assumptions about business—about pricing, measurement, optimization, and value itself—require fundamental reconceptualization.

The Path Forward

What does this mean for the future of business? Three critical shifts emerge:

- From Measurement to Meaning: Beyond simple metrics to experience construction, past optimization to coherence, and through data to understanding.

- From Features to Frameworks: Beyond product attributes to value narratives, past service delivery to experience design, through efficiency to effectiveness.

- From Control to Coherence: Beyond management to alignment, past prediction to pattern recognition, and through command to comprehension.

The Ultimate Question

Remember our original question: Why do billion-dollar companies consistently fail to understand basic human psychology? We can now see that the answer lies not in their lack of data or analysis but in their fundamental conceptual framework.

The solution to the Paddington Station problem—allowing early passengers to board earlier trains—isn't just about operational efficiency. It represents a deeper truth: The most powerful business solutions often come not from changing objective reality but from aligning with psychological reality.

A Call to Action

As we stand at the threshold of an AI-driven future, this understanding becomes more crucial than ever. The businesses that thrive will be those that:

- Recognize the constructed nature of human experience

- Design for psychological reality rather than just physical efficiency

- Create coherent value narratives that align with neural processing

- Measure what matters to the brain, not just what's easy to count

The Final Insight

Perhaps the most profound implication of our journey is this: The gap between business metrics and human psychology isn't a bug in the system—it's a feature of consciousness itself. Our task isn't to eliminate this gap but to bridge it, creating business systems that work with, rather than against, the brain's natural architecture.

As we watch those trains depart from Paddington Station, we might reflect on a final irony: The greatest opportunities for business innovation may not lie in changing objective reality but in understanding and aligning with the way human beings actually experience it.

The future belongs not to those who can measure most precisely, but to those who can align most coherently with the fundamental nature of human experience.

The question is no longer whether to adapt to this new understanding, but how quickly we can transform our businesses to reflect it.

Courtesy of your friendly neighborhood,

🌶️ Khayyam

Glossary of Key Terms and Concepts

- The Great Marketing Delusion: The persistent belief that consumer behavior can be understood and optimized through purely objective metrics, ignoring the fundamental role of psychological construction in human experience.

- Measurement Paradox: The more precisely we attempt to measure consumer behavior, the more likely we are to miss the fundamental psychological realities driving that behavior.

- Perception-Value Principle: Value does not exist as an inherent property of products or services, but emerges from the interaction between physical reality and neural processing.

- Adaptive Construction Model: Explains how the brain constructs experience through three key mechanisms: Perceptual Integration, Predictive Processing, and Evolutionary Optimization.

- Neural Value Equation: Perceived Value = ∫(Context × Expectation × Sensory Input) dt

- The Observer Effect in Business: The act of measuring an experience fundamentally alters that experience, often in ways that render the original measurement meaningless.

- Precision Fallacy: The belief that more decimal places equal more truth, leading to overvaluing easily measured metrics and undervaluing crucial psychological factors.

- Price-Value Matrix: A dynamic system where price serves not just as a cost signal but as a crucial input into the experience of value itself.

- Coherence Cascade: The process by which various signals (like price and taste) reinforce each other to create a cohesive value experience.

- Signal Integration Principle: Price acts as a crucial input signal in the brain's construction of experiential value.

- Uncertainty Resolution Model: Explains how resolving key uncertainties for customers can be more effective than traditional marketing approaches.

- Adaptive Value Construction: The evolutionary basis for seemingly irrational price-processing mechanisms in the brain.

- Neurometric Business Design: A systematic methodology for creating business solutions that align with the brain's natural value-construction mechanisms while maintaining measurable performance metrics.

- Coherence Rule: The principle of examining an entire value proposition for signal alignment across pricing, product design, and contextual cues.

- Integration Protocol: A systematic approach to mapping customer experience construction, identifying key signal touchpoints, and designing coherent value narratives.

Member discussion