Splash in the AI Pool 🔮

Amazon is known for defying the status quo, evidenced by its recent alliance with leading AI research firm, Anthropic. This echo-inducing leap into artificial intelligence could have significant implications for the financial sector, most notably for FTX creditors, who are lenders within the Financial Technology (FTX) sector engaged in cryptocurrency operations. History showcases comparable shifts in other tech powerhouses: consider when Google’s DeepMind upheaved the gaming world. If Amazon can create similarly transformative technology, such as robust AI-designed cybersecurity systems, it could drastically reshape risk profiles for FTX creditors.

A Financial Facelift: AI’s Financial Revolution

However, AI’s revolutionizing touch goes beyond basic commerce. It triggers tectonic shifts in finance, introducing innovations like robo-advisors, which offer data-driven investment insights. As Business Insider Intelligence suggests robo-advisors will oversee around $4.6 trillion by 2022, a newfound expanse for financial diversification opens up specifically for FTX creditors, who will benefit from these data-rich, automated advisory services.

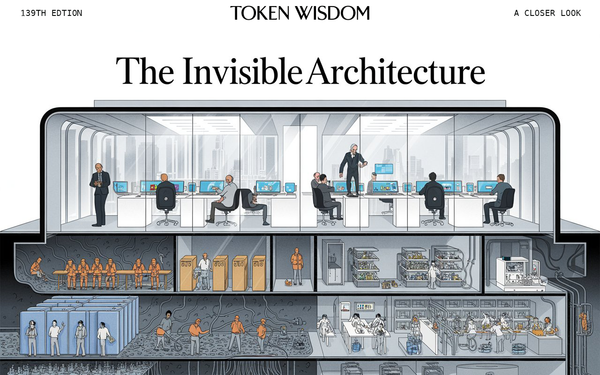

Harmony in Progress and Prudence: Assessing Innovations and Risks

Amazon’s rapid AI expansion might disguise potential pitfalls, most notably for smaller firms trying to compete. It becomes critical for FTX creditors — who typically lend to these smaller businesses — to be vigilant while navigating this advanced technological landscape. Additionally, Amazon’s AI advancements illuminate valid privacy concerns. FTX creditors must actively partake in policy discussions aimed at balancing the forward momentum of tech innovation while safeguarding privacy rights.

A Future Blueprint: Upholding Foresight in the AI-Age

Beyond the immediate horizons of AI, we see Decentralized Finance (DeFi) and digital assets gaining attention. DeFi leverages blockchain to vitalize classic financial systems. Envision the scale of transformation if Amazon conglomerates AI and DeFi, building a finance model without traditional intermediaries. This could herald fresh horizons for diversification and potential returns for FTX creditors.

Velocity of Finance and Technology Intersection: A Sprint of Foresight

Amazon’s entry into Anthropic signals an inevitable grand communion of finance with technology. Considering a PWC report that predicts 77% of financial institutions will incorporate AI into their operations, this calls for a comprehensive review of AI ethics and regulations. FTX creditors must navigate the complex technological landscape carefully, not only monitoring current implications but also anticipating future disruptions.

In an economy where stagnation equates to backwardness, the urgency for proactive change cannot be understated. For FTX creditors, emphasizing foresight offers protection for their investments in rapid, technological change. As Simon Sinek aptly points out,

“Understanding is necessary, foresight is crucial.”

This principle guides us through the complicated, yet fascinating, landscape of technological advancement.

⚉ Thanks for cruising by the Cult of Innovation ⚉

We’re making some Stone Soup here and if you enjoyed this amuse-bouche of innovative compilation of breakthroughs in bite-sized morsels, please share with your friends and help feed a community. Mmmm. #nomnom.

You can find me elsewhere on the innanets:

- I’m repping ✨ Token Wisdom on LinkedIn

- I’m @worthafortune on Twitter 🧐

- And all the rest is on my Bento

Member discussion